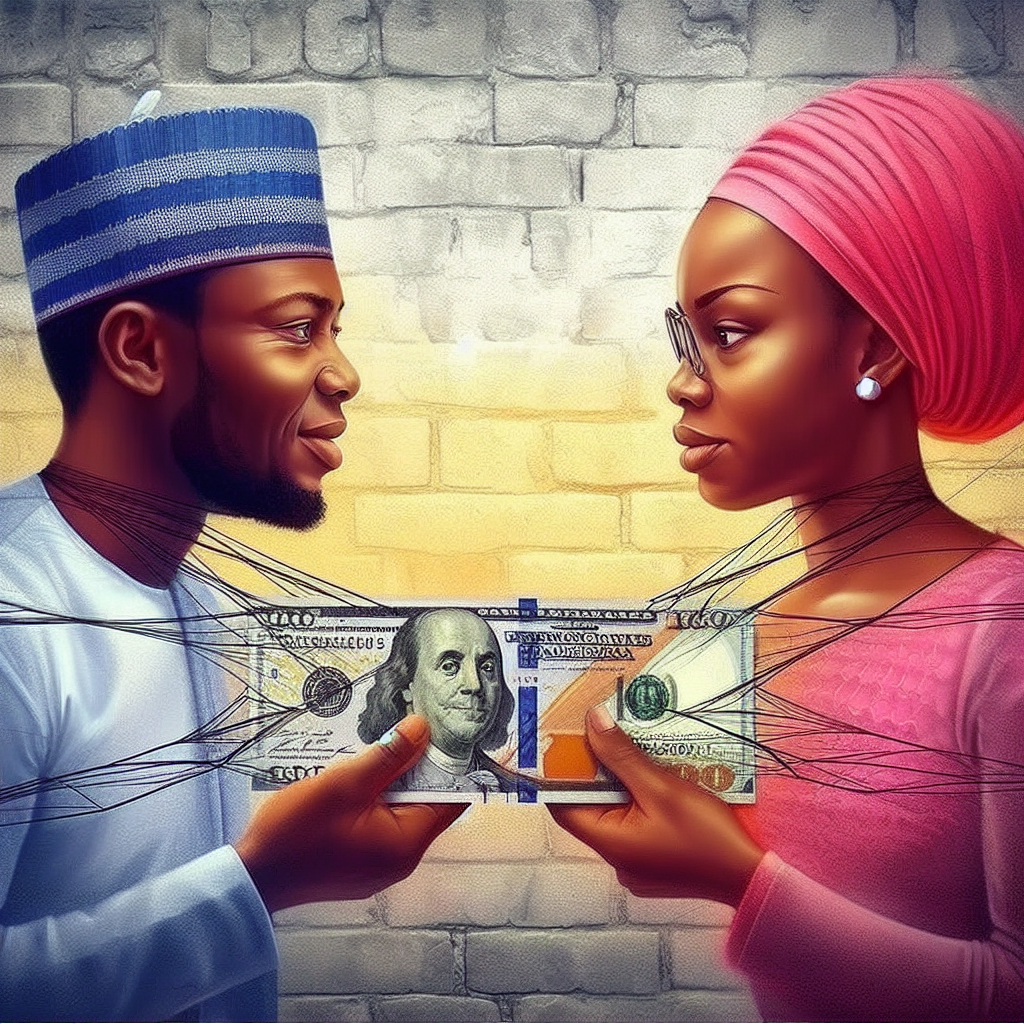

Money has a significant influence on many aspects of our lives, especially our relationships.

Nigerian artiste, Davido, really spelled this out, in his song, assurance, when he said, Love is sweet, oh When money enter, love is sweeter.

Thus, whether you are in the early stages of a new romance or facing financial challenges with your significant other, the dynamics of money and relationships are complex and often difficult to handle.

Money can be a source of conflict, stress, and even breakups. It is important to communicate openly and honestly about money and to address any issues that arise.

Establishing clear financial goals and creating financial plans can help to ensure that money does not become a source of conflict in your relationship.

Having regular discussions about money can help identify any potential issues and create a plan for resolving them.

Establishing a budget together and tracking expenses can also help to ensure that money is being used responsibly.

Creating a shared savings account can also help to build trust and demonstrate that both partners are contributing to the success of the relationship.

In this in-depth exploration, we’re going to dive into the nitty-gritty of how money affects relationships and offer some helpful tips on building a strong financial partnership.

So let’s get started and discover how to nurture a healthy money relationship together!

The Beginning: Discussing Money in Dating

1. Establishing a foundation

In the initial stages of a relationship, talking about money may seem premature.

However, it is essential to establish open communication from the start.

Discussing financial values, spending habits, and long-term goals helps set the groundwork for a healthy financial relationship.

2. Navigating Different Financial Backgrounds

People often bring diverse financial backgrounds into relationships.

It is crucial to recognize and respect these differences to understand your partner’s perspective and avoid potential conflicts.

Building a Life Together: Managing Finances in Long-Term Relationships

1. Deciding on joint finances

As relationships progress, the question of combining finances arises. Some couples choose to merge everything, while others prefer to maintain financial independence.

The key is to find a system that aligns with both partners’ comfort levels and values.

2. Creating Shared Goals

Having shared financial goals can strengthen a relationship. Whether it’s saving for a home, planning for a family, or investing for the future, having common objectives fosters a sense of unity and purpose.

3. Teamwork in Financial Planning

Collaborative financial planning involves both partners actively participating in budgeting, investment decisions, and long-term financial strategies.

This not only ensures shared responsibility but also strengthens the sense of partnership.

Navigating Challenges: Dealing with Money Conflicts in Relationships

1. Identifying Common Sources of Conflict

Money conflicts can arise from various sources, such as different spending habits, undisclosed debts, or disagreements about financial priorities.

Identifying these sources is the first step towards resolving conflicts.

2. The Impact of Power Dynamics

Financial disparities can sometimes lead to imbalances of power within a relationship. Open communication and a willingness to address these dynamics are crucial for maintaining equity.

3. Dealing with Financial Infidelity

Hidden financial behaviours, such as secret spending or undisclosed debts, can damage trust in a relationship.

Tackling financial infidelity requires honesty, understanding, and a commitment to rebuilding trust.

Practical Tips for Financial Harmony

1. Having Regular Discussions:

Regular check-ins about finances provide an opportunity to discuss goals, address concerns, and ensure that both partners are on the same page.

Setting aside dedicated time for these conversations fosters transparency and understanding.

2. Creating a Joint Budget:

A joint budget can be a powerful tool for managing shared expenses and aligning financial priorities.

It also serves as a visual representation of the couple’s financial plan.

3. Maintaining Individual and Joint Accounts:

For couples with different spending habits or financial independence preferences, maintaining separate accounts alongside a joint account can strike a balance between autonomy and shared responsibility.

4. Seeking Professional Help:

When faced with complex financial issues, seeking the guidance of a financial advisor or counsellor can provide valuable insights and mediation.

Growing Together: Achieving Financial Success in a Long-Term Relationship

1. Adapting to Life Changes:

Life is full of changes, and adapting to them together is essential for relationship success. This includes adjusting financial plans as careers evolve, family dynamics change, or unexpected challenges arise.

2. Celebrating Financial Milestones:

Recognizing and celebrating financial milestones, whether big or small, strengthens the sense of accomplishment and encourages continued financial success.

3. Maintaining Flexibility and Understanding:

Flexibility and understanding are crucial in navigating the twists and turns of financial life.

Being understanding during challenging times and celebrating each other’s financial strengths contribute to a resilient relationship.

Note: The relationship between money and relationships is complex but manageable.

Open communication, shared goals, and a commitment to understanding each other’s financial values are the cornerstones of a healthy financial partnership.

Embracing the journey of growing together, both financially and emotionally, can lead to a relationship that withstands the tests of time.

Remember, it is not just about money; it is also about the connection you build along the way.

Video Resource: